Standard deduction increase expected in budget 2025. If you are 65 or older or blind, you can claim an additional standard deduction.

For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150.

2025 Tax Code Changes Everything You Need To Know, Seniors over age 65 may claim an additional standard deduction. For the 2025 tax year, which is filed in early 2025, the federal standard deduction for single filers and married folks filing separately was $14,600.

Standard Deduction 2025 For Single Rica Venita, Finance minister nirmala sitharaman is likely to present union budget 2025 this month. And the standard deduction for.

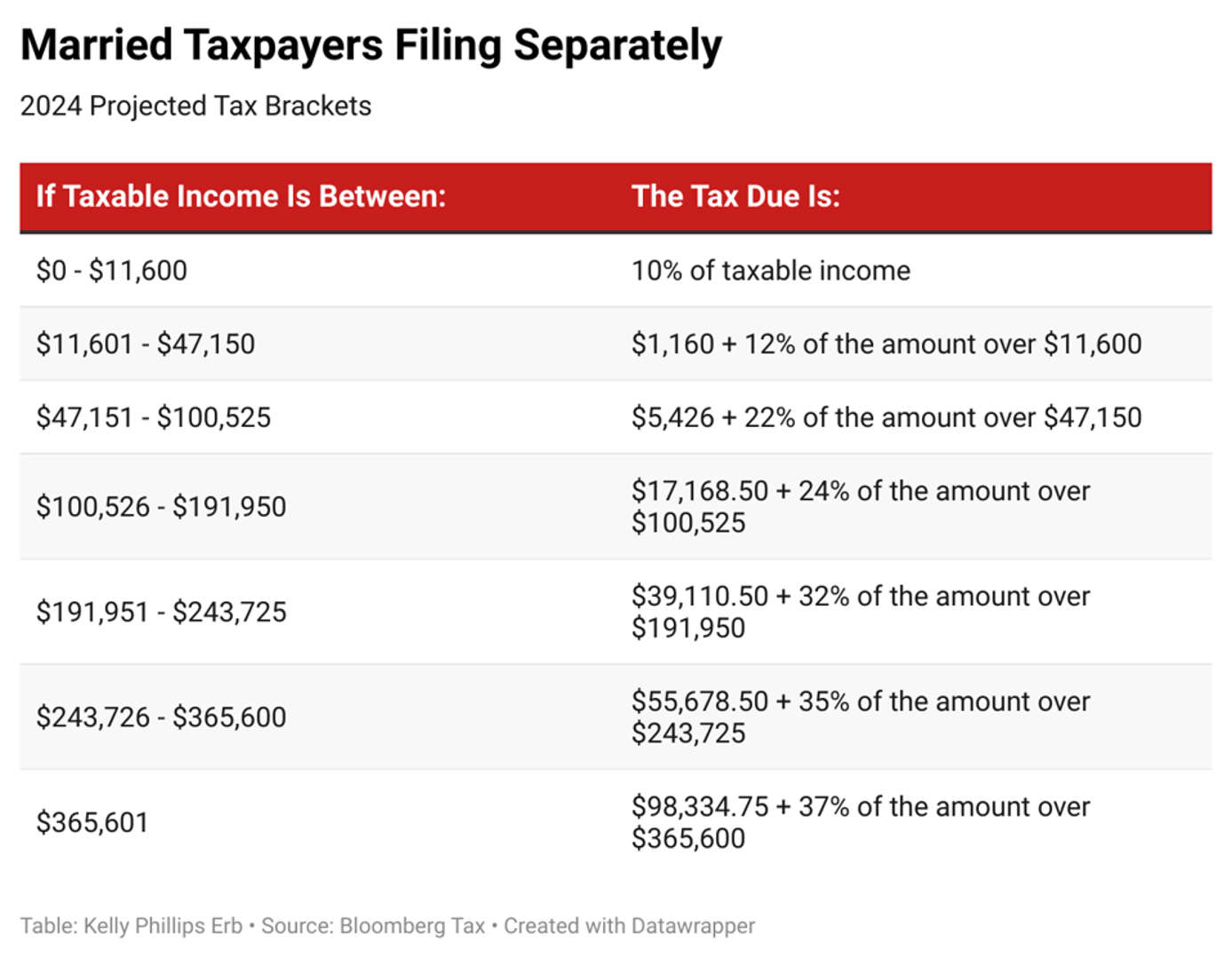

2025 Tax Brackets Single Irs Aura Melita, 10% on the first $11,600. A single taxpayer with taxable income of $125,000 in 2025 will be taxed as follows:

Tax Standard Deduction 2025 Lesya Octavia, Standard deduction increase expected in budget 2025. Here are the standard deduction amounts set by the irs:

Irs New Tax Brackets 2025 Elene Hedvige, For the 2025 tax year, which is filed in early 2025, the federal standard deduction for single filers and married folks filing separately was $14,600. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

2025 Standard Deduction For Single Filers Ola Lauryn, Here are the standard deduction amounts set by the irs: For the tax year 2025, single filers (people who are not married and do not qualify for any other filing status) are eligible for.

Standard Deduction For Single 2025 Inna Renata, People 65 or older may be eligible for a higher amount. For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for.

Tax Bracket For Single Person 2025 Cora Meriel, Will budget 2025 increase standard deduction: 2025 standard deduction for single filers.

2025 Tax Brackets Vs 2025 Taxes Korie Thelma, Increase to boost consumption and economic. If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, The 2025 standard deduction is $14,600 for single filers, $29,200 for joint filers and $21,900 for heads of household. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to pay.